Drive Cardholder Loyalty with More Sustainable Options

The demand for more sustainable payment products is heating up. According to a November 2022 CPI survey conducted by an independent research firm*, 73% of debit and credit cardholders surveyed indicated that it is important that their financial institution is environmentally conscious. In addition, 89% of respondents expressed concern about plastic waste in landfills, and […]

Why Your Card Program Should Include a Digital Payment Solution

Click here to Download Infographic Digital payments are growing rapidly. What’s driving the growth? Innovation, simplicity, convenience, and security. Offering a modern physical card program that incorporates a complementary digital payment solution is vital to stay relevant in today’s competitive market and cater to all your cardholders’ needs. Learn more about Push Provisioning, CPI’s ® […]

How to Develop a Robust Card Program

Today’s payment card environment pulses with possibility. But with that potential comes a host of complexities and challenges for the cardholder experience, compliance, and security so offering the right mix of solutions is vital. From payment card industry (PCI) compliance requirements to EMV® certification, and digital provisioning, a single source provider helps manage it all. […]

5 Things to Consider When Evaluating a Card Solutions Provider

In today’s fast-paced, lean environment, having a single-source provider to oversee every detail of your portfolio just makes business sense. In selecting that relationship, card issuers should identify a supplier whose culture and values align with their own, and who has the expertise to guide the program on its journey from launch to ongoing execution. […]

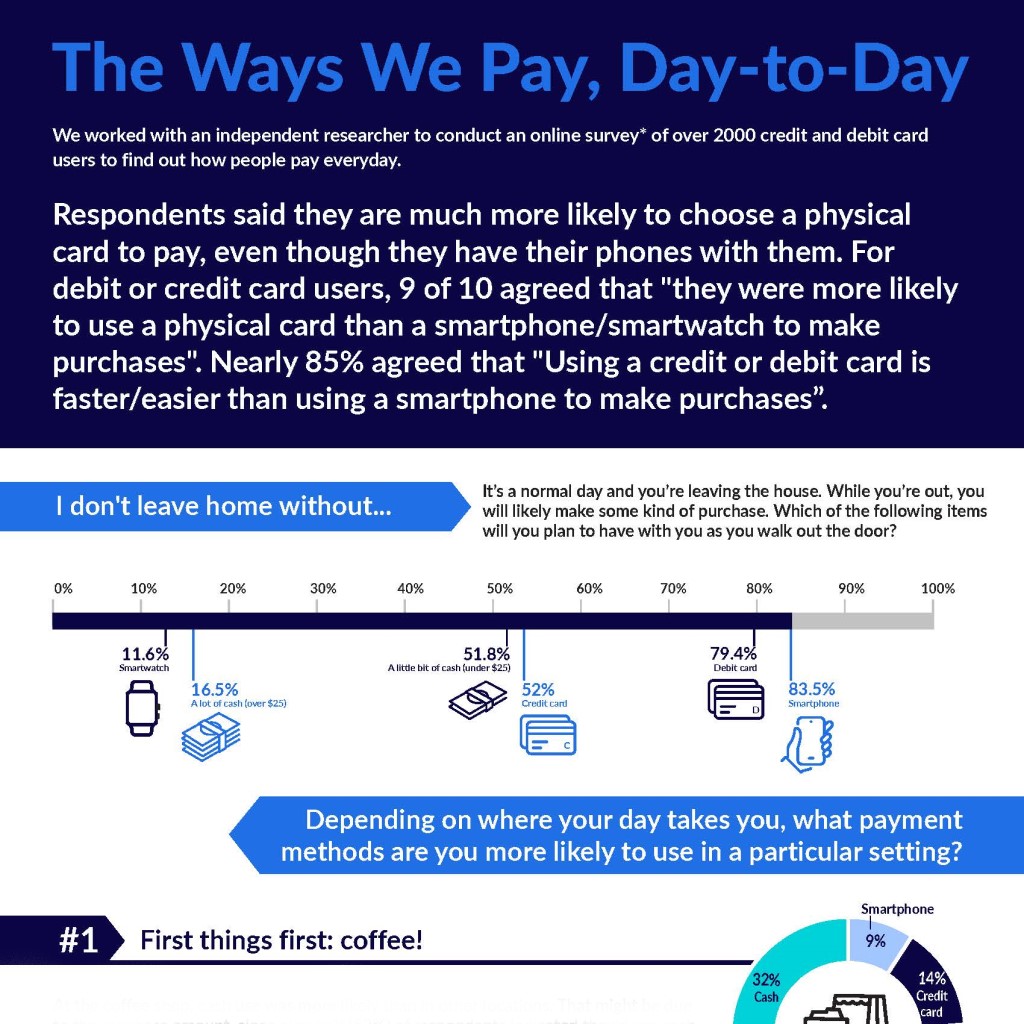

The Ways We Pay, Day-to-Day

Click here to Download PDF We worked with an independent researcher to conduct an online survey of over 2000 credit and debit card users to find out how people pay everyday. Respondents said they are much more likely to choose a physical card to pay, even though they have their phones with them. For debit […]

Why You Should Consider an Omnichannel Payments Strategy

Click here to Download PDF

Ways to Build and Elevate Your Card Program

Today’s payment card environment is undoubtedly complex and competitive, but it pulses with possibility. Identifying a card program’s competitive edge is key to maintaining top-of-wallet status and fulfilling cardholders’ expectations. Before we dive into ways that issuers can extend their brand and stand out among the competition, it is essential that issuers have built a […]

The Way Consumers Pay

Smartphones are ever-present as we move through our day, and are rarely out-of-reach, so brands and advertisements persistently push phone-based interactions to deepen that customer connection: “text this number, scan this QR code, download our app,” etc. This poses a burning question:

What You Need to Know About Building a Card Program Foundation

Building a solid card program foundation starts with a thorough evaluation of both the financial institution’s needs as well as those of its cardholders to ensure the right mix of solutions for both.

3 Ways Push Provisioning Works to Elevate the Digital Payments Experience

Extend your central and instant issuance strategy with a complementary digital payment solution to give cardholders the convenience and options they want. In February 2020, Aite-Novarica Group issued a study of 34 retail banking associates and card services executives that said: “Multiple issuers refer to instant digital card issuance as an alternative to in-branch instant […]