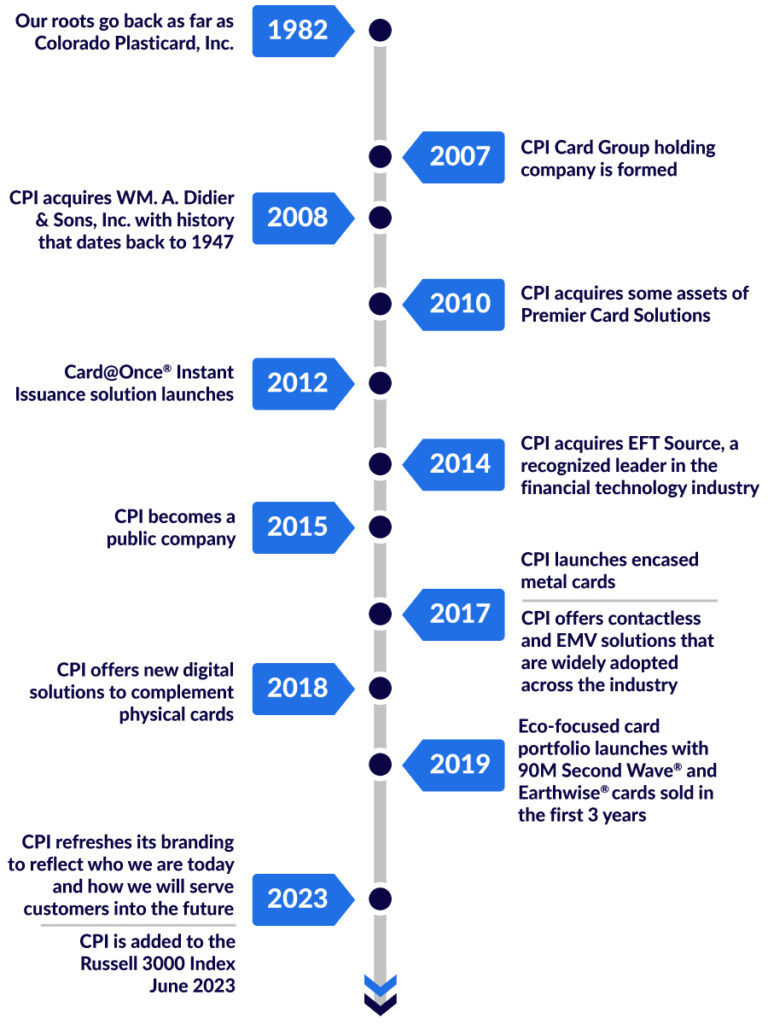

CPI provides a comprehensive range of debit, credit, and prepaid cards, digital payment technology, and related solutions to financial institutions, fintechs, prepaid programs, and other industries.

Our strong relationships and tailored solutions help our customers lead the payments industry with high-quality products that support their brands and help them drive top-of-wallet status and payments revenue.

Our key relationships include many of the largest U.S. issuers of debit and credit cards, the largest managers of prepaid debit card programs, and thousands of independent community banks, credit unions, group service providers, and card processors.

We offer our customers the ability to keep up with a fast-paced industry and demanding consumer expectations, and we’re proud that our top 10 customers have an average tenure of more than 10 years.

With decades of experience, we provide a full spectrum of physical and digital payment solutions that incorporate technology and security.

We work closely with our customers across the payments ecosystem – from card design, production, personalization, and fulfillment, to instant issuance and prepaid solutions – to help them offer choice, convenience, and control to consumers.

We’re constantly innovating to better serve our customers and to transform our industry, with market-leading solutions from eco-focused cards to SaaS-based instant issuance to complementary digital and push provisioning solutions. Here, innovation is more than new products and services—it’s a state of mind that inspires our work each day.

Our sustainability initiatives include reducing natural resource and energy consumption, creating innovative, value-add products and solutions that reuse and leverage recycled materials, and recycling activities to divert waste from entering the environment.

John Lowe has more than two decades of senior executive and financial leadership experience. He joined CPI as Chief Financial Officer in 2018 and also served as SVP & General Manager of Secure Card and Executive Vice President, End-to-End Payment Solutions before assuming the President and CEO role in January 2024. Prior to joining CPI, Lowe spent eight years at SquareTwo Financial Corp., most recently as Chief Financial Officer, and spent his early career within the Capital Markets and Audit practices at Deloitte. Lowe graduated from Virginia Polytechnic Institute and State University with a Bachelor of Science in both Accounting and Finance.

Donna Abbey has been with CPI since March 2022. Prior to joining us, Ms. Abbey provided financial and accounting consulting services to clients in various industries. She held roles of increasing responsibility at Western Union, including Vice President of Financial Reporting, Governance & Consolidations, and Chief of Staff to the Chief Executive Officer. Prior to joining Western Union, Ms. Abbey worked in the audit practice of KPMG. Ms. Abbey holds a Bachelor of Science degree in Business Administration from Colorado State University and is a Certified Public Accountant in the State of Colorado.

Jessica Browne served as Deputy General Counsel since joining CPI in October 2022. She brings over 15 years of experience, holding various positions including as the General Counsel at Gold Resource Corporation and an as attorney with Dufford and Brown P.C. supporting heavy industry. Ms. Browne a Bachelor of Science in Business Administration from University of Texas at Dallas, a Juris Doctor from University of Colorado, and a Master of Laws Taxation from University of Denver Sturm College of Law.

Rob Dixon leads the product, growth, and innovation strategy for CPI’s portfolio of Instant Issuance, Personalization and Digital solutions, as well as business development activities to expand the company’s product and solution set. He previously served as Director, Head of Product and Business Development for CPI’s digital, instant issuance, and personalization services. Mr. Dixon has over 15 years of experience bringing growth products to market and building strategic partnerships. Prior to joining CPI in 2016, he held various leadership roles in product, portfolio management and strategy for several companies including NCR Corporation, Fiserv and TSYS. Mr. Dixon is a graduate of Ohio University and holds a Bachelors of Arts in Economics and Business Administration.

Diane Felton has served as our Chief of Staff since January of 2020. She joined CPI in December 2018 as the Executive Assistant to the CEO, working closely with the Board of Directors and the full CPI Executive Leadership Team. Prior to CPI, she worked at First Data Corporation (now Fiserv) from 2001 – 2018 in various roles including Director Internal Audit, Project Manager for the Treasurer and SVP Tax, and Executive Assistant to the CFO. Prior to First Data, she held various human resources, marketing, and financial positions with Cyprus Amax Minerals Company and Wellogix. She also worked for Brunswick Corporation on their Staff of Champions and was on the Professional Bowlers Tour for 8 years. Ms. Felton holds a Bachelor of Science in Business from Colorado State University.

Terra Grantham joined CPI in 2017 and has held several roles within the company, including Vice President of Sustainability, Strategy, ESG, and Partnerships and as Vice President of Transformation and Director of Financial Planning & Analysis. Prior to joining CPI, Ms. Grantham worked at Western Union and Unilever in a variety of finance, product and strategy roles. Ms. Grantham received her Bachelor’s degree in Economics from Grinnell College, and a Master in Business Administration from the University of Michigan’s Ross School of Business.

Jeffrey Hochstadt was appointed as CPI’s Chief Financial Officer in 2023. Prior to joining CPI, he served as Founder of Jazmin LLC, providing strategic and financial consulting services, and as a Senior Advisor to Simon-Kucher and Partners. He served in various roles at Western Union, including Chief Strategy Officer and Senior Vice President Head of Global Financial Planning and Analysis. Mr. Hochstadt’s prior experience includes stints with First Data, Morgan Stanley Capital International, IBM, A.G. Edwards and Sons, and Price Waterhouse. He holds a Master of Business Administration from the Wharton School at the University of Pennsylvania and a Bachelor of Science in Business Administration from the John M. Olin School of Business at Washington University in St. Louis.

JD Porter joined CPI as our Chief Commercial Officer in May 2023 and is responsible for all customer-facing relationships for our Debit and Credit Segments, focusing on large issuers, small to medium issuers, implementations, pre-sales and design, client services and enterprise strategic relationships. He brings over 20 years of financial services experience, with the past 10+ years focused on the payments space. Mr. Porter has held various leadership roles with Fiserv, Wells Fargo, SunTrust (now Truist Financial Corporation), and Elavon, spanning nationwide sales and business unit leadership across multiple verticals within the financial services industry. Mr. Porter has a Bachelor of Science in Management from the University of Alabama at Birmingham.

Mike Salop joined CPI as SVP, Investor Relations in July 2023, previously working in the same capacity as a consultant since 2021. Mike has extensive investor and analyst relationships, as well as deep knowledge of finance, treasury and capital structure strategies. He has held financial leadership positions at Western Union and Mattel. Mr. Salop has a Bachelor of Business Administration in Finance from University of Texas at Austin and a Masters of Business Administration from Columbia University.

Grace Sims joined CPI in 2020 from KIOSK Information Systems, where she served as Vice President of Supply Chain. In this role, Ms. Sims was responsible for Purchasing, Planning, Inventory Management, Warehouse Management, Logistics, Facilities, Quality, and Management of ISO 9001:2015 + ISO 14001:2015. Ms. Sims held a variety of positions with increasing responsibilities, including Director of Global Supply Chain and Director of Materials Management with key companies such as Terumo BCT and Delphi Medical Systems. Ms. Sims holds a Bachelor of Business Administration and Master of Business Administration from the University of Denver and a Ph.D. in Organization and Management from Capella University.

Beth Starkey joined CPI in 2021 from FIS/Worldpay, most recently holding the position of Global Head of Merchant Experience & Advocacy Marketing with FIS. She held various marketing roles with First Data (now Fiserv), including Marketing Director. Additionally, Ms. Starkey held a variety of marketing, communications, and consultant roles with several companies before joining First Data. Beth holds a Bachelor of Arts degree in Journalism from The University of North Carolina at Chapel Hill.

Toni Thompson joined CPI in September 2023 and is responsible for our operations strategy and organization. She brings over 20 years of expertise in the print industry, having held executive roles at RR Donnelley, spanning IT, Business Development, Operations, Supply Chain & Logistics, and Manufacturing. Most recently, Ms. Thompson was President of Retail Solutions at RR Donnelley, which included the buildout and responsibility for four manufacturing facilities, sales, client services, design & innovation, and care for over 700 employees. Ms. Thompson also served as a business unit leader for RR Donnelley Logistics, supporting seven mail consolidation facilities. She has expertise in leading transformations, leveraging technology and automation to drive growth. Ms. Thompson has a Bachelor of Business Administration from DePaul University.

Sonya Vollmer joined CPI Card Group in 2021 as Director of Total Rewards before moving into her current CHRO role. Prior to CPI, she held human resources leadership roles across a variety of manufacturing industries, including healthcare/life sciences, industrial automation, and metals. She also served in consulting roles with Hewitt Associates (now Aon) and in her own consulting firm. Sonya holds a Bachelor of Arts degree in Economics from the University of Wisconsin-Parkside and an Executive MBA from the University of Wisconsin-Milwaukee.

Beth Williams joined CPI in 2016 as Technology Director, leading teams focused on Instant Issuance, Prepaid, and Personalization before moving into her current CTO role. Prior to joining CPI, Ms. Williams served as the Chief Information Officer for EFT Source, a card personalization and instant issuance solution provider. Ms. Williams held a variety of positions with increasing responsibilities, including programming, web and software development, and analysis at companies such as KeyBank, Deloitte Consulting, NFIB, and Vanderbilt University Medical Center. Ms. Williams holds a Bachelor of Business Administration – MIS from Ohio University.

Named as one of the 2023-2024 Best Companies to Work For by U.S. News & World Report

Sustainability Product of the Year

In 2022, CPI was named BIG’s winner of the Sustainability Product of the Year for the Earth Elements portfolio of cards, including Second Wave and Earthwise – cards that incorporate upcycled plastic into the card’s construction.

Best Green Initiative

In 2022, CPI was named finalist of the Paytech Best Green Initiative Award Category for the Earth Elements portfolio of cards, including Second Wave and Earthwise – cards that incorporate upcycled plastic into the card’s construction.

Product & Service

Business-to-Business Products Category

CPI was named the winner of a Gold Stevie® in the Product & Service – Business-to-Business Products Category for Earthwise™ Recycled-PETG Plastic Cards in the 2021 19th Annual American Business Awards.

The American Business Awards are the U.S.A.’s premier business awards program. The mission of the Stevie Awards is to recognize and generate public awareness of excellence in the workplace worldwide. The American Business Awards are the only national, all-encompassing business awards program in the United States.

Product & Service

Business-to-Business Products Category

In 2020, CPI secured a Gold Stevie® in the Product & Service – Business-to-Business Products Category for Second Wave Recovered Ocean-Bound Plastic Cards, and in 2018, a Bronze Stevie® Award was received for Card@Once instant issuance in the New Products – Business-to-Business Products category.

The American Business Awards are the U.S.A.’s premier business awards program. The mission of the Stevie Awards is to recognize and generate public awareness of excellence in the workplace worldwide. The American Business Awards are the only national, all-encompassing business awards program in the United States.

Best Secure Environmentally Friendly

Payment Card

Best Secure Payment Card

ICMA acts as a resource for industry issues, including the production, technology, application, security and environmental issues of cards. CPI has been recognized for its innovative card design through the ICMA Élan Awards.

In 2022, CPI was named finalist in two categories, receiving recognition for Best Feature Card for a metal design for Rize Latitude, and People’s Choice for Wells Fargo Reflect.

In 2021, CPI was named the winner of an award for Best Secure Environmentally Friendly Payment Card for a large tier financial issuer’s debit card featuring a core made with recovered ocean-bound plastic

In 2020, CPI received several Elan Awards, including Best Secure Payment Card for the BMW Credit Card, Best Secure Payment Card – Finalist for the RCI Ocean EMV Card, Best Secure Metal Payment Card for PSCU Corporate Card and Best Personalization & Fulfillment (P&F) Product, Service or Project for the Oxygen Debit Card Package.

ICMA ACE Accreditation

Advanced Card Education (ACE) designations are awarded to professionals who successfully complete a rigorous exam demonstrating abilities and knowledge in technologies and processes specific to card manufacturing or personalization and fulfillment. CPI Card Group has graduated more than 60 individuals across the ICMA’s ACE program, including ACE-P, ACE-M, and ACE-A – the most of any company in the world.

Recognizing the importance of instant issuance in today’s financial marketplace, the Best in Biz Awards named CPI Card Group’s innovative Card@Once solution a 2018 silver winner in the Enterprise Product of the Year – All Others category.

CPI received the 2016 Center of Excellence Award at the Secure Technology Alliance’s annual member meeting. The program recognizes member companies who reach the highest level of active participation in the Secure Technology Alliance, a not-for-profit, multi-industry association focused on smart card technology. As the U.S. payments market continues to evolve rapidly, CPI was recognized for its role in supporting the migration to EMV payments by providing market insights and education.

With a focus on building personal relationships and earning trust, we help our customers navigate the constantly evolving world of payments, while delivering innovative solutions that spark connections and support their brands.

We serve clients across industry, size, and scale through our team of experienced, dedicated employees and our network of high-security production and card services facilities.

CPI is committed to exceeding our customers’ expectations, transforming our industry, and enhancing the way people pay every day.

Connect with a sales representative for a quote or schedule a demonstration.

Check order status or connect with a representative for assistance with a product.

©2023 CPI Card Group Inc. All Rights Reserved

Card@Once is a registered trademark of CPI Card Group Inc.: U.S. Patent No.: 8429075 and 10,275,747 and multiple patents outside of the United States.

Encased metal products and production technology are protected by the following patents of CPI Card Group Inc.: U.S. 8,857,722, 9,117,155, 9,430,724, 9,779,343; 10,032,099; 10,255,536; 10,445,628, 10,824,926; 11,301,735 Canada 2,879,639, 3,073,852; UK GB2519046; Japan 6777836; Korea 10-2208865

Ultrasecure card package is protected by U.S. Patent Nos.: 10,625,915, 9,049,909, 11,267,628 and 11,034,497

EMV® is a registered trademark in the U.S. and other countries and an unregistered trademark elsewhere. The EMV trademark is owned by EMVCo, LLC. The Contactless Indicator mark, consisting of four graduating arcs, is a trademark owned by and used with permission of EMVCo, LLC.

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept”, you consent to the use of ALL the cookies.