Keep your cards top-of-wallet with a strong card program

Building a solid card program foundation starts with a thorough evaluation of both the financial institution’s needs as well as those of its cardholders to ensure the right mix of solutions for both. Issuers with an established program will want to explore how their existing and target bases will respond to new offerings. They’ll also likely want to be aware of the latest market trends, as well as the new products or approaches they should be evaluating. An experienced single-source provider will have the resources to help navigate these developments in line with the issuer’s unique business goals.

There’s no denying that the demand for immediacy continues to drive consumer behaviors. In an environment where same-day product delivery exists, consumers expect quick service. One of the most significant tasks facing an issuer is selecting the right issuance approach. There are benefits to both instant issuance and central issuance. And as a new consideration, complementary digital offerings must weigh into either approach when evaluating the right holistic strategy.

Central issuance

The central issuance model delivers a debit or credit card by mail to the accountholder’s mailing address. The best use-case for central issuance has traditionally been the disbursement for batches of personalization data and is ideally suited for new account openings, rebranding, technology updates, or natural reissuance.

There are two variations in central issuance. In one, an issuer bulk prints branded cards that are stored in a vault for ongoing personalization orders. In the other, print-on-demand typically uses blank cardstock with full-color, edge-to-edge imagery and personalization printed simultaneously. Print-on-demand has come a long way, and card options can be as customized as the issuer requires. Coupled with a zero-inventory model, this opens the door for more strategic targeting of cardholder audiences.

Instant issuance

Instant Issuance offers the best of both worlds, allowing cardholders to have a card in hand and on their phone before leaving the branch. Plus, instant issuance creates higher activation rates and allows cardholders same or next-day spending power.

Additional efficiencies result from offering instant issuance through SaaS (Software as a Service) solutions which provide institutions simplicity and scale, making it a reliable option for those with limited internal IT and other resources. SaaS options are continuing to gain traction, as evidenced by reports that show a growing acceptance of cloud-based solutions by the financial services industry. A 2021 survey of financial service industry executives showed at the time that their firms operated, on average, 38% of their business applications through the cloud, and they anticipated that percentage would increase to 55% in two years. That growing acceptance breeds comfort and familiarity, meaning issuers are increasingly looking to cloud-based solutions as an alternative to hosting an on-site server.

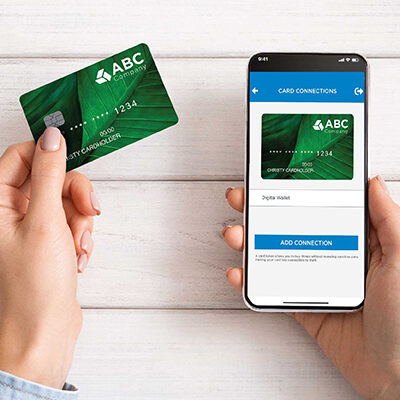

Complementary digital strategy

Complementary digital strategy

While physical cards remain the most accepted and preferred payment method for purchases, having a card issuance strategy that incorporates a digital component supports cardholder choice and control. So how can financial institutions support their accountholders in adding their physical debit and credit card information to their digital wallets? Digital payment options through push provisioning have allowed card program managers to address the issue more proactively so that users don’t need to figure this out themselves. Push provisioning tokenizes the cardholder’s payment card credentials to a mobile wallet for new or existing accounts, creating a complementary digital option that supports both immediate and ongoing cardholder needs for convenience and choice.

At the end of the day, issuers should position themselves as the payment option of choice to keep their cards top-of-wallet for cardholders. From payment card industry (PCI) compliance requirements to EMV® certification and digital provisioning, a single-source provider helps manage it all. This ensures the program is built from a solid foundation, leveling up to meet the financial institution’s needs—and those of its cardholders.

Learn more about CPI's full spectrum solutions